Who is Warren Buffett? – Buffett is the chairman and largest shareholder of Berkshire Hathaway, the investment group that’s delivered a 19.8% compounded annual gain in market value since 1965. The Omaha, Nebraska-based company owns Geico, Clayton Homes and Dairy Queen, and has stakes in Coca-Cola and American Express.

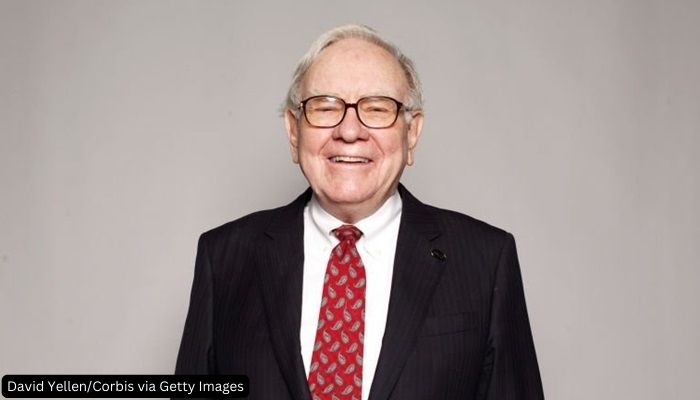

Warren Buffett – CEO, Berkshire Hathaway Inc. (Cl A):

- Known as the “Oracle of Omaha,” Warren Buffett is one of the most successful investors of all time.

- Buffett runs Berkshire Hathaway, which owns dozens of companies, including insurer Geico, battery maker Duracell and restaurant chain Dairy Queen.

- The son of a U.S. congressman, he first bought stock at age 11 and first filed taxes at age 13.

- He has promised to donate over 99% of his wealth. So far he has given some $55 billion, mostly through the Gates Foundation and his kids’ foundations.

- In 2010, he and Bill Gates launched the Giving Pledge, asking other billionaires to commit to donating at least half of their fortune to charitable causes.

Warren Buffett Biography:

Milestones:

- 1930 Warren Edward Buffett is born in Omaha, Nebraska.

- 1951 Graduates from Columbia University with an economics degree.

- 1952 Marries Susan Thompson. The couple have three children together.

- 1959 Introduced to Charlie Munger, who becomes lifelong business partner.

- 1970 Becomes chairman and CEO of Berkshire Hathaway.

- 1976 Berkshire shares rise more than 129 percent this year, their biggest gain.

- 2006 Marries Astrid Menks two years after the death of first wife, Susan.

- 2013 Berkshire Hathaway and 3G agree to buy Heinz for $23 billion.

2007–08 financial crisis:

Buffett ran into criticism during the subprime mortgage crisis of 2007 and 2008, part of the Great Recession starting in 2007, that he had allocated capital too early resulting in suboptimal deals. “Buy American. I am.” he wrote for an opinion piece published in the New York Times in 2008. Buffett called the downturn in the financial sector that started in 2007 “poetic justice”. Buffett’s Berkshire Hathaway suffered a 77% drop in earnings during Q3 2008 and several of his later deals suffered large mark-to-market losses.

A capitalized Berkshire:

On August 14, 2014, the price of Berkshire Hathaway’s shares hit $200,000 a share for the first time, capitalizing the company at $328 billion. While Buffett had given away much of his stock to charities by this time, he still held 321,000 shares worth $64.2 billion. On August 20, 2014, Berkshire Hathaway was fined $896,000 for failing to report December 9, 2013, purchase of shares in USG Corporation as required.

Investment philosophy:

Buffett’s writings include his annual reports and various articles. Buffett is recognized by communicators as a great story-teller, as evidenced by his annual letters to shareholders. He has warned about the pernicious effects of inflation:

The arithmetic makes it plain that inflation is a far more devastating tax than anything that has been enacted by our legislatures. The inflation tax has a fantastic ability to simply consume capital. It makes no difference to a widow with her savings in a 5 percent passbook account whether she pays 100 percent income tax on her interest income during a period of zero inflation, or pays no income taxes during years of 5 percent inflation.

— Buffett, Fortune (1977)